As high-net worth individuals continue to wedge a gap between low-income individuals during the pandemic, luxury tourism could see a stronger recovery period over the next few years as travel restrictions begin to ease.

Projections show an optimistic future for luxury tourism

According to Investopedia, a financial website based in New York, the number of millionaires within America reached almost 22 million in 2021, where it witnessed the most significant year-on-year (YoY) growth within this economic group over any other nation, globally. Over the next three years, these statistics will have a considerable impact on the luxury tourism industry. According to GlobalData’s Hotels Database, the total revenue from leisure travellers spent on luxury hotels in the US is expected to grow at a compound annual growth rate (CAGR) of 25.2% between 2021 and 2024. In addition, total hotel revenue from leisure travellers in luxury hotels showed the strongest YoY recovery compared to any other hotel sector in 2021, with revenue increasing by 147%. This is a noteworthy increase in comparison to the US budget hotel sub-sector, which experienced a YoY revenue increase of just 42%.

An increase in high spending on luxury tourism bodes well for recovery

According to the Knight Frank 2021 Wealth Report, at the start of 2020 a US passport-holder could claim visa-free access, or visa-on-arrival, to 171 countries. However, by 2021, that figure decreased to only 103, due to Covid-19 lockdowns, and related travel restrictions. If travellers were to hold citizenship for two countries, they would have considerably more freedom. According to a Bloomberg report, having never previously considered doing so, many ultra-high net worth individuals, especially US citizens, , are seeking out new options for alternative residencies and citizenship. As a result, this helped provide them with more freedom to go abroad during the height of travel restrictions. Furthermore, 24% of ultra-high net-worth individuals planned to apply for a second passport or citizenship in 2021. This means that, with restrictions lessening, those high-net-worth individuals that were unable to obtain travelling freedom during the pandemic will now be more likely to travel to luxury destinations.

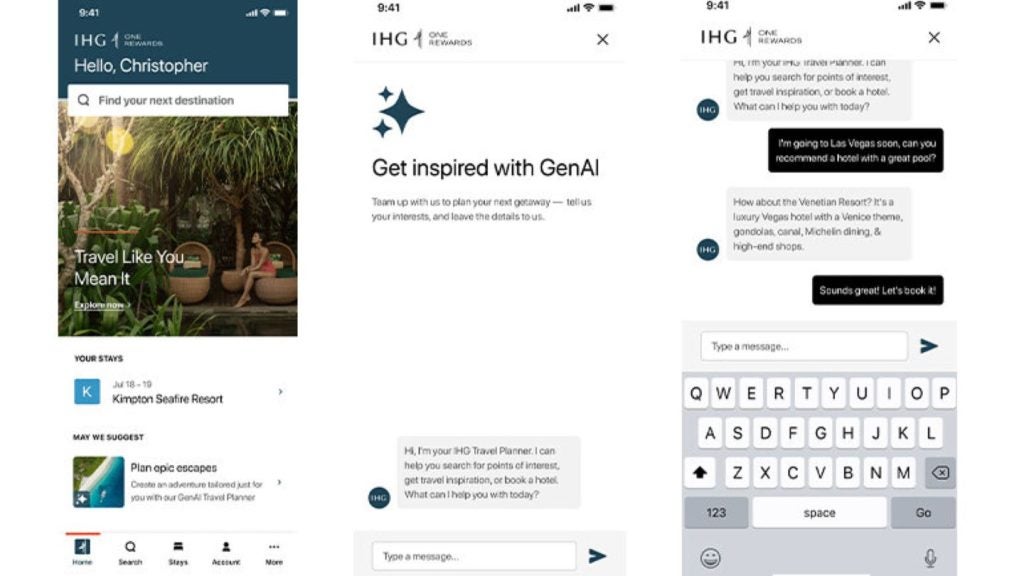

Luxury tourism will be an area of focus for some travel companies

The ongoing recovery of luxury tourism looks to be in good stead as the number of high-net-worth individuals continues to grow across the US. Increasing amounts of disposable income will undoubtedly boost demand for premium products and services. Destinations and companies that can offer the most unique and authentic experiences to US travellers stand to increase their share in this lucrative market. Increases in disposable income may have been created through accidental saving due to pandemic-induced restrictions on movement, or through favourable economic conditions. As such, spending within the luxury sector is likely to increase. This is also reflected in a recent GlobalData poll from January 2022, which yielded some surprising results*. 28.3% of respondents said that their holiday budget will was ‘slightly’ or ‘a lot higher’ than pre-Covid-19. This development bodes well for the future of luxury tourism. As high-net worth individuals have gained more favourably than other individuals during the pandemic, it is likely these are the type of consumers where budgets have increased. As such, many travel and tourism companies will look to attract more luxury travellers to aid pandemic recovery.

*GlobalData Verdict Poll – “How has your holiday budget for future trips changed due to COVID-19?” – Closed 17 January 2022 – 428 responses

See Also:

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

Bloomberg LP