Statistics show that the travel and tourism industry is on the verge of returning to pre-Covid-19 numbers despite persistent concerns to do with staff shortages, cybersecurity breaches and technological disruption.

International tourism is on track to recover 90% of pre-pandemic traffic by the end of 2023, according to data from the United Nations World Tourism Organisation (UNTWO).

An estimated 975 million tourists travelled internationally between January and September – a 38% increase on the same period in 2022.

“International tourism has almost completely recovered from the unprecedented crisis of Covid-19, with many destinations reaching or even exceeding pre-pandemic arrivals and receipts”, said UNWTO Secretary-General Zurab Pololikashvili. “This is critical for destinations, businesses, and communities where the sector is a major lifeline."

The travel and tourism industry’s share of the global market has also bounced back emphatically.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIn 2022, the industry accounted for 7.6% of global GDP, a figure which is expected to rise to 9.2% by the end of 2023. Travel and tourism was valued at 10.4% of global GDP in 2019.

As this recovery in growth continues, analysts from GlobalData, the parent company of Hotel Management Network, pinpointed three main issues the travel and tourism industry had to contend with in 2023 – and will continue to grapple with in 2024.

AI takes off

From education to energy, finance to healthcare, artificial intelligence (AI) had a near-ubiquitous impact across industries globally in 2023 – and tourism has been no exception.

“Hotel operators are still trying to get to grips with this emerging yet possibly transformative technology, but many within the industry see great potential in it,” says Nicholas Wyatt, Head of Analysis at GlobalData Travel and Tourism.

Early uses of AI in tourism have included monitoring maintenance needs in hotel rooms, optimising energy usage, forecasting demand and adjusting room availability accordingly.

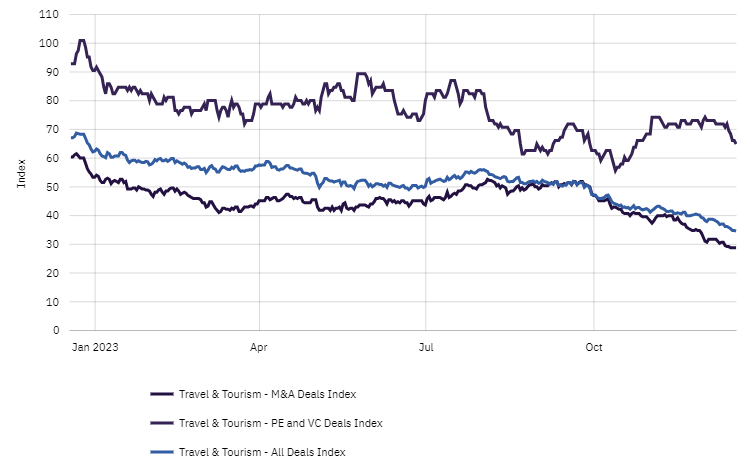

With the overall volume of global travel and tourism deals dipping in Q4 2023, industry experts are eager to demonstrate efforts to modernise through new technologies like AI.

“The most obvious use case is for generative AI to perform labour-intensive but repetitive tasks that consume staff time,” Wyatt adds. “This time could be better spent serving guests directly, thus elevating their experience – a key driver of repeat bookings.”

Much like budget airlines, automated systems are largely accepted by customers of budget accommodation options.

Vueling and Wizz Air, for example, have implemented automated airport check-in systems with relatively little backlash.

48% of consumers say they do not care whether they get their information from bots or call centres, according to a survey from Opus.

“AI chatbots that make recommendations and answer FAQs quickly and effectively are the most obvious example,” Wyatt says. “The lodging industry can look to the travel intermediary space for inspiration, most notably Expedia’s generative AI chatbot.”

Complaints arose, however, about the lack of human touch with AI-powered customer service systems – particularly when adopted by higher-end tourism brands. Customers of more expensive airlines and hotel chains typically demand a more personalised service than an automated check-in system.

“Chronic” staff shortages

AI has been touted as a potential solution to the tourism industry’s most pressing problem.

The number of global jobs in the industry declined from 333 million in 2019 to 271 million jobs in 2020 as airlines, hotels and tour operators trimmed workforces to stay afloat during the pandemic.

Poor treatment and career reconsideration led many skilled tourism workers to leave the industry, and companies have struggled to replace them.

AI’s capacity to free up staff time could be a “boon to hotels” as the industry continues to wrestle with “chronic staff shortages”, according to Wyatt.

“Hotels have struggled to lure back some of the workers that left the industry at the height of the pandemic as the travel sector virtually ground to a halt,” he says. “This situation has been exacerbated by struggles to attract new workers and the result is an almost worldwide issue with staffing.”

From 2022 to 2032, the travel and tourism sector is predicted to add 126 million new jobs, according to the World Travel and Tourism’s Staff Shortages report.

The US-led tourism job hirings in 2023, according to research by GlobalData.

These statistics mark a significant recovery from the travel and tourism industry’s “state of survival”, as the report puts it, in 2020, although recent political decisions have threatened to jeopardise this.

In the UK, for instance, Home Secretary James Cleverly recently unveiled the government’s controversial immigration plan, which raises the earning threshold for a skilled worker visa from £26,200 ($33,100) to £38,700 ($48,900).

Hospitality leaders have warned that the plan, which comes into force early next year, will “further shrink” the tourism talent pool.

MGM and Booking.com hit with cyberattacks

If staff shortages are a deeply embedded industry issue, cybersecurity has become an emerging threat preoccupying travel and tourism businesses.

“2023 saw several high-profile data breaches, including international hotel chain MGM Resorts’ cybersecurity incident in September,” says Megan Cross, Associate Analyst at GlobalData Travel and Tourism. “With the scale and sensitivity of data held on travellers, ensuring strong protection measures is imperative.”

In January 2023, Hilton admitted to a high-profile cyberattack in which roughly 500,000 reservation records were breached.

Despite initially claiming there had been no such attack, Hilton was eventually fined $700,000 by a New York attorney for violating the GDPR.

“The lodging industry holds highly valuable and sensitive data on every guest,” adds Cross. “If these data points are not well protected, there are significant risks for customers, who could have their data stolen.”

In November, Booking.com faced similar scrutiny after hackers obtained the login details for its hotel partners through the dark web.

Booking.com is one of the most used websites for holidaymakers, but cyberattacks and fraud cases have been reported from customers in the UK, US, Netherlands, Italy, Greece, Singapore and Indonesia.

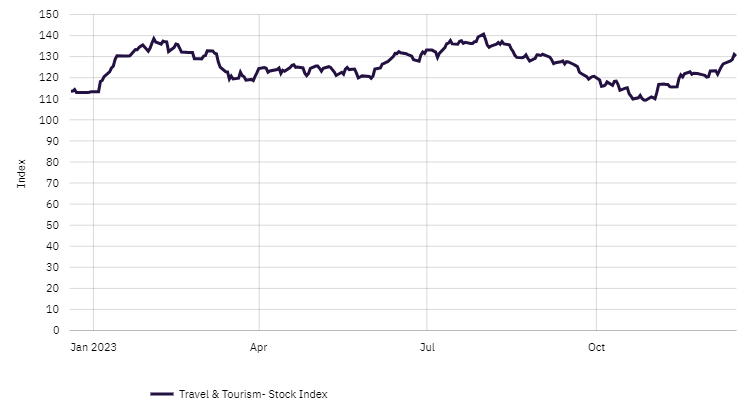

Despite cybersecurity breaches and endemic staff shortages, the average stock price of leading travel and tourism companies has remained steady throughout 2023, rising slightly overall.

“In 2024, the cybersecurity landscape for travel and tourism will be pivotal as the reliance on digital platforms continues to grow”, Cross concludes. “The industry must stay ahead in implementing advanced cybersecurity practices to maintain the trust of customers.”