Off-peak travel has a track record of being a hit with younger travellers. Travel and tourism companies need to start, or continue to, target Millennials and Gen Z with offerings away from busy summer periods that create value for money, and authentic experiences.

According to GlobalData, there were 2 billion holiday takers within the age range of 25-34 in 2021, which made it the second highest for its number of holiday takers, behind 35-49. A significant contributing factor as to why there are so many holiday takers in the 25-34 age range is their ability to travel during off-peak periods. Many young Millennial and Gen Z travellers have no children or major responsibilities in terms of occupational and financial obligations. This means they do not have to travel within set periods each year.

Value for money drives demand for off-peak travel

34% of Gen Z and 36% of Millennials stated that they were ‘extremely concerned’ about their personal financial situation, which were the two highest percentages out of all the age cohorts included in the survey*.

With prices for flights and accommodation being their cheapest in times of low demand, many young travellers in Europe, for example, will often holiday internationally in March or November. They may even travel more than once in off-peak periods during the same year if low-cost carriers (LCCs) and budget accommodation providers are offering very cheap prices.

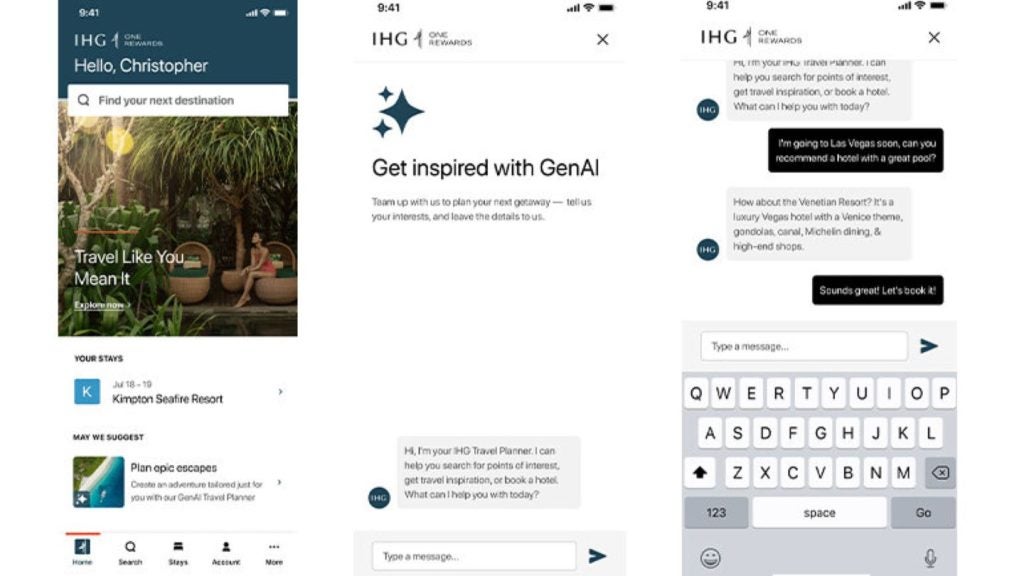

Travel apps are often used by LCCs to send push notifications to younger travellers regarding last minute deals that could inspire a spontaneous purchase. This channel is impactful, and should be considered by other companies looking to attract young travellers in off-peak months. An innovative and attractive app is needed for this channel to be effective, as push notifications can often not be sent if the user does not have the company’s app downloaded on to their mobile device.

See Also:

Authenticity is another key pull factor

Personification and authenticity are especially important to younger travellers. 27% of Gen Z and 26% of Millennials stated that they are ‘always’ influenced by how well a product or service is tailored to their needs and personality**. These were the two highest percentages when compared to the remaining age cohorts that responded to this question.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataOff-peak travel provides travellers with more authentic and personal touristic experiences. During peak tourism months in established destinations, visitor numbers will often outweigh the number of local residents, and all aspects of tourism infrastructure will be overcrowded. In off-peak months, travellers are more likely to have meaningful interactions with locals, and experience cultural and natural attractions in a more intimate fashion due to less crowding. This allows for a better overall experience and a more positive perception of a destination.

As destinations and travel companies continue to recover from the pandemic, younger travellers that can more easily travel in off-peak months should be targeted with low cost and authentic experiences. This will reduce the impact of seasonality and boost revenue.

*GlobalData’s Q4 2021 Consumer Survey

**GlobalData’s Q1 2021 Consumer Survey

Related Company Profiles

GEN Z LP