As many Chinese cities continue with stringent lockdowns, stay at home orders and mass testing, questions are being raised about the economic toll and the impact on domestic tourism of the nation’s “zero-COVID” strategy. Meanwhile, some cities are scrambling to attract domestic tourists with tax breaks and cheap prices.

Domestic tourism falls as Omicron takes hold

China began its most extensive coronavirus lockdown in two years in early March, to conduct mass testing and control a growing outbreak in Shanghai. A number of Chinese cities have followed suit by urging citizens to stay home to similarly control the spread of the Omicron variant, including Zhengzhou, Xian and Suzhou.

Prior to the pandemic, China’s domestic tourism market was thriving, with 3.1 billion domestic tourists in 2019. This declined by 43% year-on-year (YoY) in 2020 to 1.8 billion, with domestic tourism numbers increasing to 2.5 billion in 2021. Now would have been a prime time to attract domestic tourists as Covid-19 has limited outbound travel, so a significant number of Chinese travellers will have re-oriented to the domestic market seeking new destinations and new experiences within China. However, coronavirus has put an end to the domestic holiday dreams of many Chinese tourists, hotels, airlines, and tour companies hoping for inter-provincial travel akin to pre-Covid-19 times look set to be disappointed for the foreseeable future.

Tourism reliant regions suffer

Particularly hurt will be provinces that rely heavily on tourism for economic growth, such as Hainan, and Yunnan. One telling example is plummeting tourism trips to Sanya, a beach destination in Hainan, sometimes dubbed ‘China’s Hawai’i’. According to official statistics reported by Reuters, during the Qingming Festival holiday, from 2 April 2 to 5 April, tourist trips dropped by 99.4%, with hotel occupancy rates averaging only 12.6%.

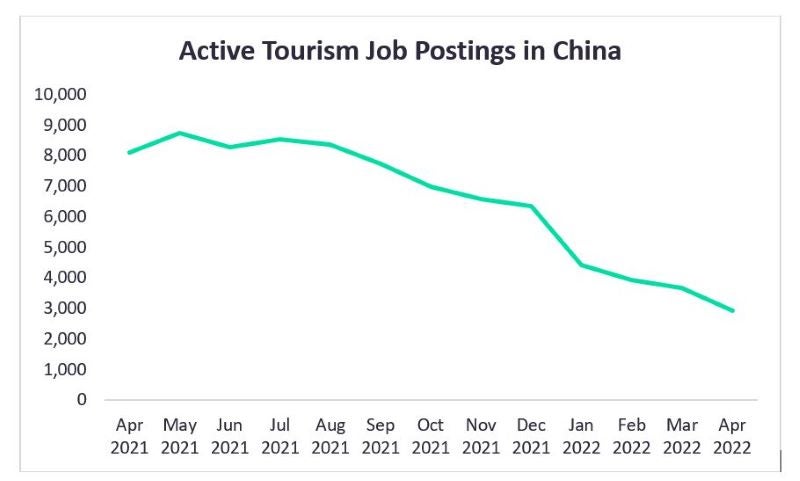

Nationally, the tourism industry is arguably the worst it’s been at any point since the start of the pandemic as the Covid-19 situation has worsened in recent months. According to GlobalData’s Job Analytics Database, active tourism job postings in China have declined by 54.7% from April 2021, to March 2022. This bodes ill for a sector that contributed 11.05% to China’s gross domestic product in 2019 and supported nearly 80 million jobs, or 10% of all employment.

See Also:

Reliance on locals and price cuts to boost tourism

In a sector that employs tens of millions of people and saw tourism expenditure of $840.0 billion in 2019, according to GlobalData’s Traveller Spending Patterns Database, it is no surprise that provinces are scrambling to attract domestic tourists. With inter-provincial travel limited, some provinces are turning to local people to help soften the blow of plummeting tourist earnings. However, local people are likely to have their cars and are unlikely to require accommodation. As such, this offers no saving grace to transportation and lodging companies in China.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataNevertheless, some provinces are choosing to slash ticket prices and offer tax breaks in a desperate attempt to drive tourism numbers. For instance, Ningxia, an autonomous region dependent on tourism in northwest China, is offering its local population of 7.2 million passes to more than 60 scenic spots for CNY199 ($31), a substantial discount considering prices are usually close to $470. Similarly, the city of Dali is attempting to lure local visitors by offering ten million consumption vouchers. Meanwhile, authorities in Yunnan have also had to roll out measures such as tax cuts to aid travel companies.

Related Company Profiles

Thomson Reuters Corp