Tighter lending standards from regional banks are making it harder for US hotel developers to secure funding, slowing the construction of new hotels at a time when Americans’ desire for travel is high, according to industry insiders.

Regional banks, the primary lenders to the hotel and commercial real estate markets, are experiencing financial strain due to the ongoing banking crisis.

This situation has forced developers to postpone projects or explore alternative ways to raise capital. The impact on the broader US economy is evident, with the collapse of several mid-sized banks and a flight of deposits to larger institutions.

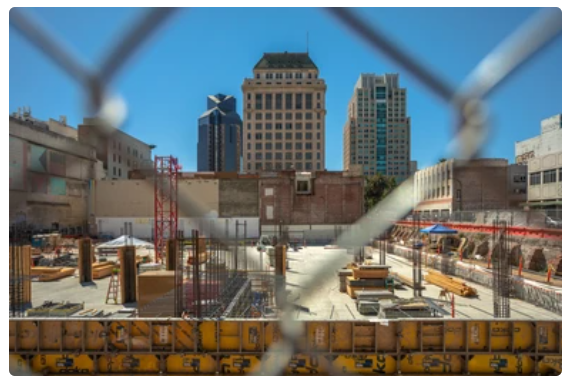

Hotel projects put on hold amid banking crisis

Since the banking crisis began in March 2023, hotel developers have faced significant challenges in obtaining financing, leading to the pause of 59 out of 98 total hotel projects in the United States.

Build Central Inc, a research and analytics firm used by large hotel brands, revealed this data, highlighting the negative effects of the regional banking crisis on the hotel industry.

But despite this setback, a total of 324 projects have either broken ground or are in the pre-construction phase in 2023.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataRegional banks retreat, impacting hotel development

The financial turmoil faced by regional banks has resulted in limited access to loans and increased construction costs, causing delays in hotel projects across Florida, Texas and California.

Construction loan approvals are taking longer due to the upheaval in regional banks. Major hotel companies including Hilton Worldwide Holdings Inc and Marriott International have warned of reduced hotel developments due to expensive and less available credit.

The repercussions of slower hotel development extend to manufacturers such as Caterpillar Inc, whose construction sales rely heavily on commercial real estate customers. Equipment purchases have declined as high interest rates for financing or leasing machinery deter customers.

Small to mid-size banks overexposed and offloading loans

Smaller banks, with assets of less than $250 billion, currently hold around $2.3 trillion in commercial real estate loans, accounting for 80% of their total liabilities.

As regional banks grapple with their exposure to commercial real estate, they have begun selling discounted loans in this sector. Troubled lender PacWest Bancorp announced the sale of $2.6 billion worth of real estate construction loans.

An analysis by S&P Global Market Intelligence showed that 14 out of 24 banks with more than $125 million in hotel and motel loans have reported quarter-over-quarter decreases, indicating a reduction in their hotel loan portfolios.

Hotel developers face mounting challenges

Even before the regional banking crisis, hotel developers were already grappling with elevated interest rates and inflated costs of raw materials due to supply chain disruptions.

Mitchell Hochberg, president of the Lightstone Group, stated that the firm is slowing down new projects as it becomes increasingly difficult to find financially viable hotel deals.

Many hotel developers are opting to wait on the sidelines for interest rates to decrease rather than take on additional costs. As the regional banking crisis continues to unfold, the hotel industry faces significant hurdles in obtaining funding for new projects.

The repercussions are felt not only in the hotel sector but also in manufacturing and by smaller banks.