While the impact of inflation will stop some from traveling internationally in 2022, the strong desire to travel for many Europeans will override worries regarding soaring energy bills and lower living standards. The purchasing of cheaper tourism related products and services to counteract inflation will allow travelers to go abroad, while ensuring they can make ends meet back at home.

Desire to travel remains

National inflation rates have been increasing dramatically in recent months across Europe, with annual inflation in the Eurozone’s 19 countries reaching 8.6% in June. This level of inflation would be expected to severely dampen demand for international travel. However, stories of packed airports across Europe continue to emerge, demonstrating that pent-up demand for international travel induced by the pandemic is still present even with inflation squeezing levels of disposable income.

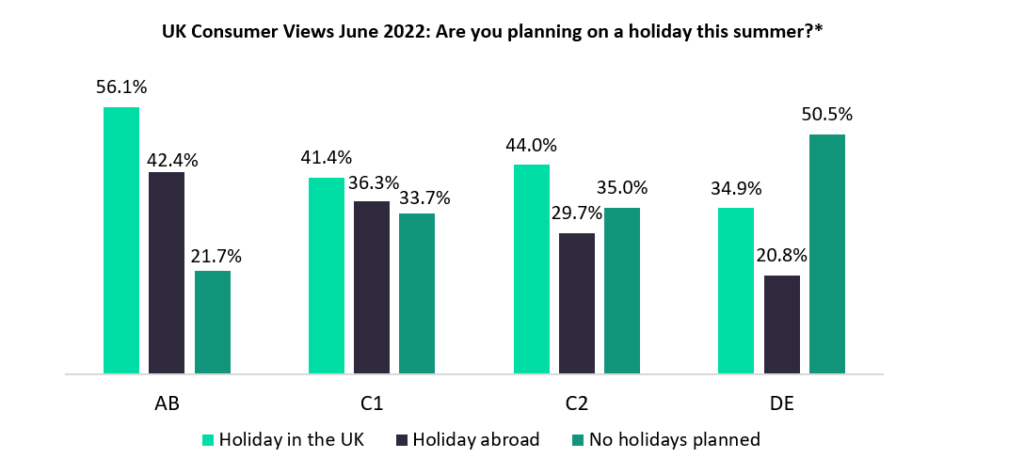

While not in the eurozone, the UK’s inflation rate has shown similar stark increases in recent months. However, demand is still present for international travel across all social grades. Even in the less affluent social band of ‘DE’, one in five respondents (20.8%) stated that they are still planning to travel internationally this summer, with consumers in this category set to be impacted the most by inflation.

Cheaper products and services to increase in importance

See Also:

A significant portion of European travelers in less affluent social bands will still be able to travel by levelling down in terms of the travel related products and services they purchase in the ‘pre’ and ‘during’ stages of a trip. This will certainly play into the hands of companies that already target budget travelers.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFor example, travelers that usually stay in midscale hotels may now lean towards budget forms of accommodation to keep costs down for their main summer holiday. This could play into the hands of low-cost providers such as Airbnb. With hosts likely feeling the pinch of inflation themselves, they may actually lower their prices to ensure occupancy is maximized during peak season and to remain competitive.

It could also spur emerging low-cost trends such as carpooling. Ride-sharing apps such as BlaBlaCar have already been experiencing solid growth in terms of users in recent years. These apps connect budget travelers with drivers that have seats going spare in their car for medium-to-long journeys. This type of app may be used by travelers looking for cheaper transportation alternatives this summer.

The impact of inflation across Europe will no doubt extend the recovery timelines of travel and tourism companies. However, the strong desire of travelers to continue traveling as a period of economic downturn looms will be facilitated by trading down, with cheaper products and services being prioritized to counteract the impact of inflation.

* The chart shows the percentage of consumers within each social grade are planning a holiday in the UK, abroad or do not have one planned this summer. Percentages for each social grade do not sum to 100% as respondents could select both holiday in the UK and holiday abroad. Data is derived from GlobalData’s 2022 monthly survey of 2,000 respondents.

Related Company Profiles

Airbnb Inc