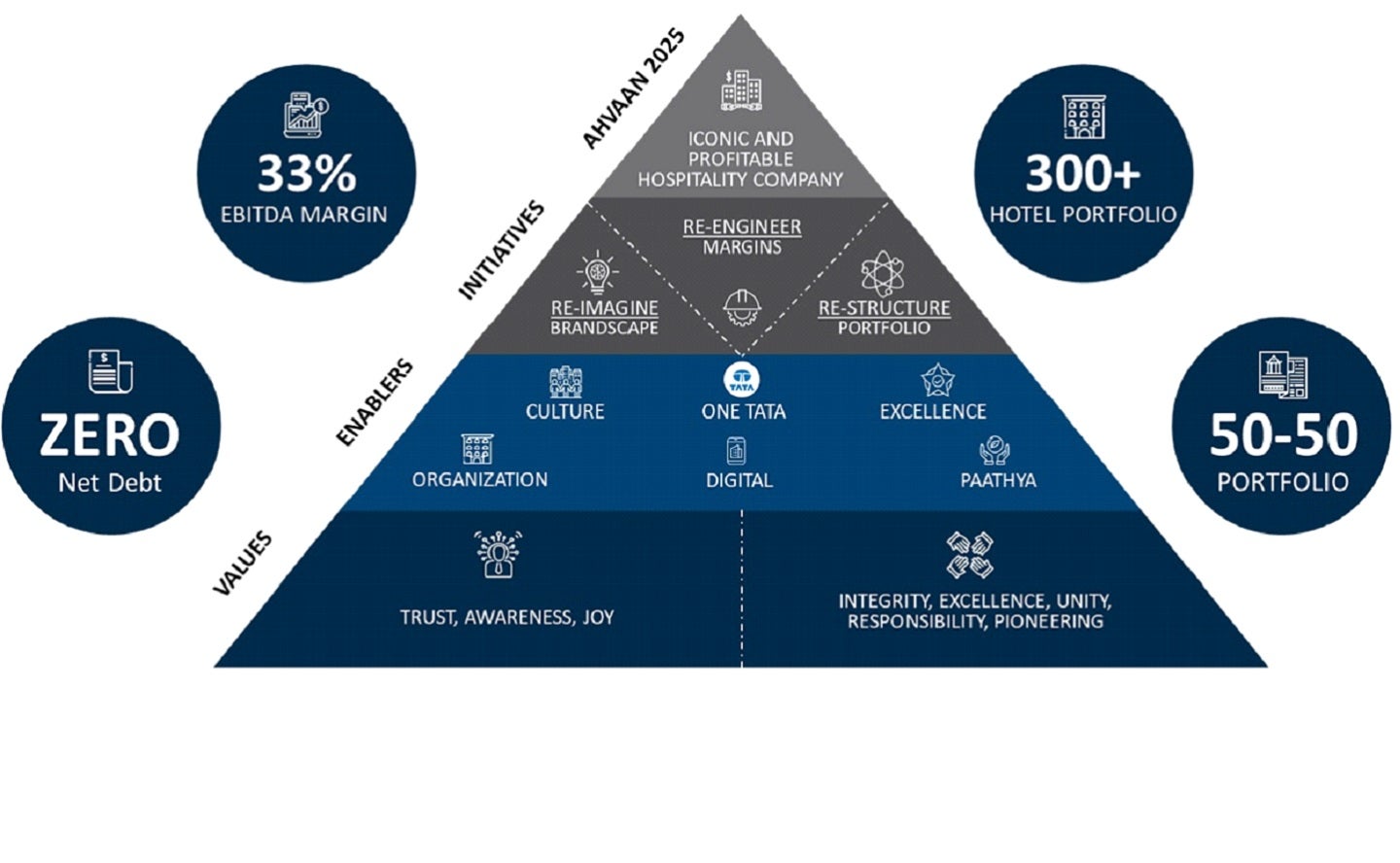

The Indian Hotels Company Limited (IHCL) has provided a progress update under the Ahvaan 2025, the company’s strategic growth roadmap.

Value generation has been a basis of this approach, which is driven by efforts such as re-engineering its traditional business, scaling its reimagined enterprises and restructuring its portfolio.

In the 2022-2023 Financial Year (FY), the brand owned or leased hotels and managed 263 properties, with a 32.7% EBITDA.

IHCL CEO and managing director Puneet Chhatwal said: “Ahvaan 2025, our comprehensive strategy to be an iconic and profitable hospitality ecosystem has witnessed a strong start.

“With four consecutive quarters of record financial performance, the company achieved an all-time high PAT of over ₹10bn ($12m) and maintained zero net debt status.

See Also:

“With its reimagined brandscape, industry-leading brands and operational excellence, strong footprint across 125+ cities, as well as the unwavering trust of guests and dedication of all colleagues guided by the ethos of Tajness, IHCL is well poised to deliver on this vision.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIHCL generated revenue growth of 20% or more and a margin increase of 15.2 percentage points.

It launched Papermoon, a global Italian brand, in Goa; debuted Loya, a new Indian restaurant concept and extended its gastropub House of Nomad and brewpub 7 Rivers in Goa.

Ginger attained a portfolio of 85 hotels and declared a PBT of ₹480m ($5.84m), making the company profitable for the first time.

TajSATS, a market leader in aircraft catering, achieved an all-time high EBITDA margin of 19.7% and a PBT of ₹1.07bn ($13m).

amã Stays and Trails’, a branded service in the homestay industry, has grown steadily to 114 outlets.

Qmin, IHCL’s culinary platform, has expanded to different formats, including as the all-day restaurant at Ginger Hotels and now has 34 outlets.

With the signing of 36 hotels, the company restructured its portfolio and established a 50:50 mix of owned or leased and managed hotels. IHCL also noted that the Taj brand has hit a landmark of 100 hotels.

As part of this strategy, IHCL aims to establish a portfolio of 300 hotels by the FY 2025-26, with a 33% EBITDA margin and a 35% EBITDA share contribution from the latest businesses and management fees.