French multinational hospitality Accor has reportedly studied a possible merger with British company InterContinental Hotels (IHG), according to French national newspaper Le Figaro report.

The speculation saw shares in Accor increase 1.9% and IHG up 0.35% after rising to 3.1% in early trading, reported Reuters.

The potential merger would create the world’s largest hotel group with a market value of approximately $17bn as per existing prices.

The report said that a taskforce has been formed that includes Accor’s financial director, investment banks Centerview and Rothschild to examine the project proposal.

Accor’s brand portfolio consists of luxury and premium, midscale and economy, as well as lifestyle smart concepts and resorts.

In the group’s 2020 half-year results, Accor said that most of its hotels were closed for around three months.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataOver the recent months, it added 12,000 new rooms to its portfolio, taking the numbers to up to 5,100 hotels and 748,000 rooms.

Accord has reopened 81% of hotels for business and noted that the group’s business model transformation is nearing completion.

Meanwhile, IHG reported that its global RevPAR declined 52% in the first half and 75% in the second quarter.

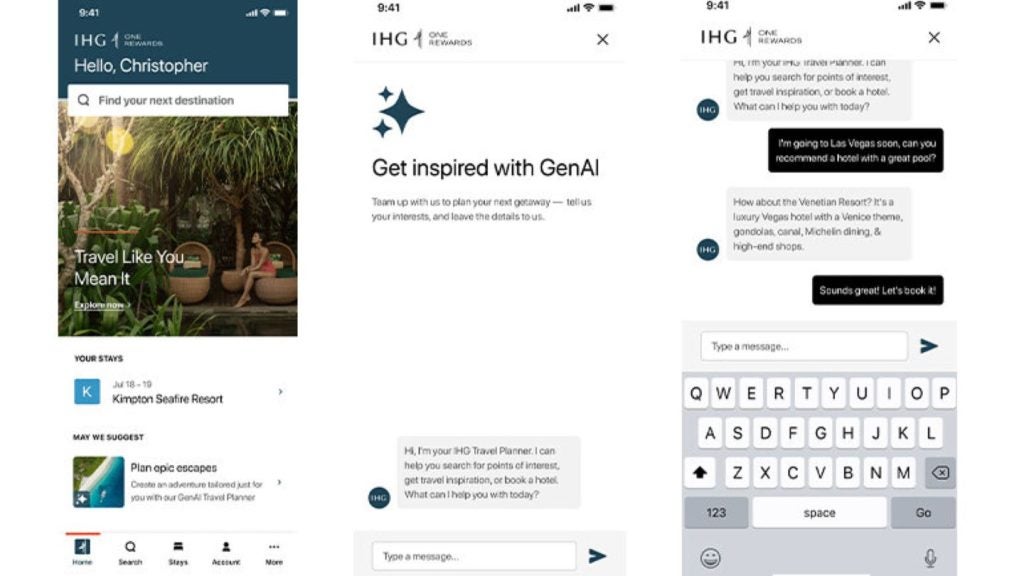

IHG has a portfolio of leading brands including Holiday Inn and Crowne Plaza. It operates more than 5,900 hotels across almost 100 countries.

The Covid-19 pandemic has impacted almost all industries, with the hospitality industry, travel and tourism being the severely affected due to several restrictions and lockdown measures.